Are REIT ETFs a good idea?

Are you looking for the best real estate investment trusts (REITs) exchange-traded funds (ETFs) to add to your financial portfolio during the second quarter of 2022? Now more than ever, investors need to be extra diligent when making sound investing decisions. REIT ETFs may be a great option as they provide diversification and low management fees, but with so many options, how do you know which ones are worth your hard-earned money? In this blog post, we'll explore some of the best REIT ETFs for Q2 2022 – from VNQ, which tracks MSCI's US residential housing index, to FXEP offering exposure to European-based REITs.

What are REIT ETFs, and why should you invest in them?

REIT ETFs are a type of investment fund that invests in real estate trusts and allows investors to gain exposure to the real estate market without having to invest directly in properties. Investing in REIT ETFs can benefit from diversification and lower costs compared to investing in individual real-estate stocks. These funds offer access to a wide range of markets and sectors since they focus on residential housing, industrial spaces, office buildings, hotels, healthcare facilities, and more.

Top 5 Best REIT ETFs for Q2 2022:

1. Vanguard Real Estate ETF (VNQ): Tracks MSCI's US Residential Housing Index and holds more than 100 stocks in the real estate sector, including apartment buildings, homebuilders, and REITs.

2. iShares US Real Estate ETF (IYR): Seeks to track the performance of an index composed of U.S-listed REITs and other real estate-related investments.

3. SPDR Dow Jones Global Real Estate ETF (RWO): Offers exposure to a broad range of global real estate sectors, including office buildings, hotels, retail stores, and residential housing across multiple countries worldwide.

4. Invesco European Real Estate Equity ETF (FXEP): Holds 50+ companies in the European real estate sector and exposes investors to various countries, sectors, and property types.

5. Schwab US REIT ETF (SCHH): Tracks the Dow Jones U.S. Select REIT Index, which includes 50+ publicly listed real estate companies in the U.S., offering diversified exposure to different areas of the U.S. real estate market.

These five REIT ETFs are some of the best options for Q2 2022 as they offer a combination of low fees, broad diversification, and access to various sectors in both domestic and international markets. Ultimately, investors need to research before investing in any financial instrument or fund – but these five REIT ETFs offer great potential for long-term growth and diversification.

How to choose the suitable REIT ETF for your portfolio?

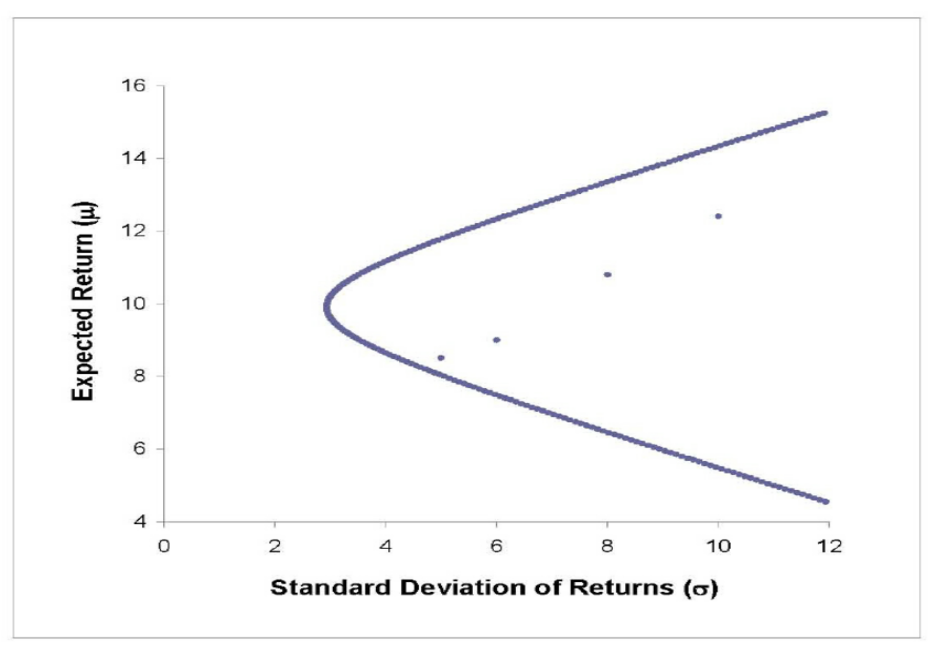

When selecting a REIT ETF for your portfolio, it's essential to research and understands the different types of real estate investments available. Additionally, investors should consider their specific investment goals and risk tolerance to select the correct fund. Finally, investors should compare fees and performance data to ensure they invest in the most cost-effective and highest-quality options.

Pros and Cons of Investing in REIT ETFs :

Pros:

Diversification: REIT ETFs provide exposure to various sectors and markets, reducing risk.

Low Management Fees: most REIT ETFs have lower management fees than other funds.

Accessibility: REIT ETFs are accessible for investors who don't have the capital or resources to invest directly in real estate.

Cons:

Price Volatility: REIT ETFs can be subject to price volatility due to market conditions and their underlying investments.

Economic Risk: Like all investments, real estate is subject to macroeconomic risks like inflation, recessions, and political uncertainty.

Factors to Consider When Choosing a REIT ETF :

Fees: Compare the management fees of different REIT ETFs to ensure you get the best deal.

Performance: Look at the historical performance of a REIT ETF to evaluate its past returns.

Diversification: Consider how diversified a REIT ETF regards holdings and sectors.

Investment Objectives: Make sure your investment objectives align with those of the REIT ETF you are considering investing in.

Risks of investing in REIT ETFs:

Investors should be aware of the risks associated with investing in REIT ETFs, including market, economic, and liquidity risks. Additionally, REIT ETFs can be subject to price volatility due to market conditions, which could result in investors losing a portion or all of their investments. Therefore, investors need to weigh the pros and cons before investing in any financial instrument or fund.

Overall, REIT ETFs offer great potential for long-term growth and diversification. With careful research and consideration of the above factors, investors can find an appropriate REIT ETF that aligns with their goals and risk tolerance. Ultimately, it is essential to remember that no investment is without risk; however, investing in REIT ETFs can help to spread out risk, provide diversification, and offer great potential for long-term growth.

Conclusion:

REIT ETFs are an excellent option for those looking for exposure to the real estate market without investing directly in properties. With so many options available, it's essential to research and selects the suitable REIT ETF for you based on your investment objectives and risk tolerance. Additionally, investors should be aware of the risks associated with investing in REIT ETFs, including market and economic risks and liquidity risks.

FAQs:

Q: What is a REIT ETF?

A: A REIT ETF is an exchange-traded fund that holds a variety of real estate investments like stocks, mortgage-backed securities, and other real estate investment trust (REIT) assets.

Q: How can investors select a suitable REIT ETF for their portfolio?

A: Investors should consider their specific investment goals and risk tolerance to select the correct fund. Additionally, investors should compare fees and performance data to ensure they invest in the most cost-effective and highest-quality options.

Q: What risks come with investing in REIT ETFs?

A: Investors should be aware of the risks associated with investing in REIT ETFs, including market and economic risks and liquidity risks. Additionally, REIT ETFs can be subject to price volatility due to market conditions, which could result in investors losing a portion or all of their investments.