Expected Return vs. Standard Deviation: What’s the Difference?

Are you figuring out the best way to manage and grow your investments? To make sound decisions, you must understand key concepts related to stock analysis. One concept to become familiar with is expected Return versus standard deviation – two fundamental elements of any investment portfolio.

Learning how to assess security or a mutual fund's performance can help greatly when you know what these terms mean and how they relate. In this blog post, we'll explain the difference between expected Returns .and standard deviationsDeviation so that you can use them more effectively to design profitable portfolios in any market.

What is the expected Return of an investment, and what is the standard deviation of an investment

The Expected Return is the average amount of money an investor can receive from their investment. Expected returns are typically expressed as a percentage and calculated using historical data such as past stock market performance or bond yields. Standard deviation measures the spread or volatility in expected returns; it measures how far away individual returns are likely from the Expected Return.

The expected Return of a given investment can be determined by looking at its historical performance or, in the case of bonds, by examining its coupon rate. Expected returns are typically calculated using an average over time, which may vary depending on the type of investment and market conditions.

Standard deviation, on the other hand, is a measure of risk. It measures the variation in individual returns relative to the expected Return. A higher standard deviation indicates greater volatility or more risks associated with an investment; conversely, a lower standard deviation implies that individual returns are less likely to deviate from the expected Return.

How do investors use these two statistics to make informed decisions?

When investors analyze the risk and returns of an investment, Expected Return vs. Standard Deviation is a metric that can help them make informed decisions. Expected Return is the average amount an investor expects to gain from investing in a particular asset or portfolio over time. On the other hand, Standard deviation measures how wide the range of returns can be from the Expected Return.

To better understand Expected Return and Standard Deviation, investors should consider both statistics when deciding. Expected Returns help them identify how much they can gain in a particular investment and their expected return rate over time.

The higher the Expected Return, the greater the chance of making a profit. Standard deviation helps better illustrate the risk associated with the Expected Return and allows investors to understand how much variance they can expect in their portfolio's performance over time.

Why should you be aware of an investment's expected Return and Standard Deviation?

Investors should know the expected Return and Standard Deviation when considering any investment. The expected Return measures what the investor expects to gain from the investment, while the standard deviation measures how much an asset's price may vary over a given period. By understanding these two measures, investors can make more informed decisions about their investments and manage their risk accordingly.

The Expected Return is the amount of Return an investor can receive from a certain investment over a certain period, such as one year or five years. Expected returns are based on the past performance of the asset and its past volatility, so investors need to doit's their research before investing toto understand the expected Return.

On the other hand, standard deviation measures how much an asset's price may vary over a given period. Standard deviation is useful for investors because it can help them gauge the risk associated with a certain investment. A higher standard deviation indicates that there is greater volatility in the security and, thus, greater risk.

How can you use this information to improve your investing strategy?

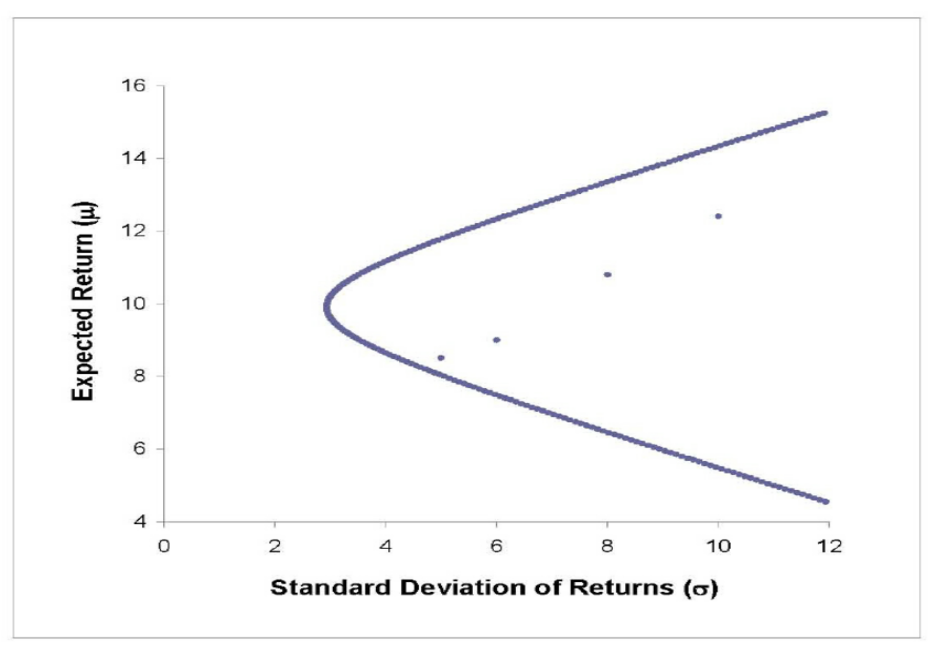

Using expected Return and standard deviation information can help you assess the risk-reward tradeoff of an investment. The expected Return measures how much, on average, you could expect to make from an investment. Standard deviation measures how volatile an investment's returns may be over time. By understanding both metrics, you can make more informed decisions when deciding which investments to pursue.

For example, a potential investor may see two stocks with similar expected returns. However, if the standard deviation for one of those stocks is much higher than the other, it implies greater risk associated with investing in the higher-risk stock. This can help investors decide whether they are willing to take the risk associated with investing in that stock.

In addition, understanding expected returns and standard deviation information could help investors construct a more diversified portfolio. If you understand both metrics for each investment in your portfolio, you can create a mix of investments with different levels of risk and reward.

Examples to help illustrate these concepts

The first scenario is a portfolio of stocks with an Expected Return of 10% and a Standard Deviation of 5%. This means that you can expect an average return of 10%. However, your returns will fluctuate between 5% and 15%. In this scenario, the Expected Return is quite high, but the Standard deviation is relatively low. This makes it a relatively safe investment with the potential for a decent return.

The second scenario is a portfolio of stocks with an Expected Return of 20% and a Standard Deviation of 10%. This means that you can expect an average return of 20%. However, your returns will fluctuate between 10% and 30%. In this scenario, the Expected Return is higher than the first example, but so is the Standard deviation. This makes it a riskier investment with the potential for greater returns.

How do you calculate each of these metrics?

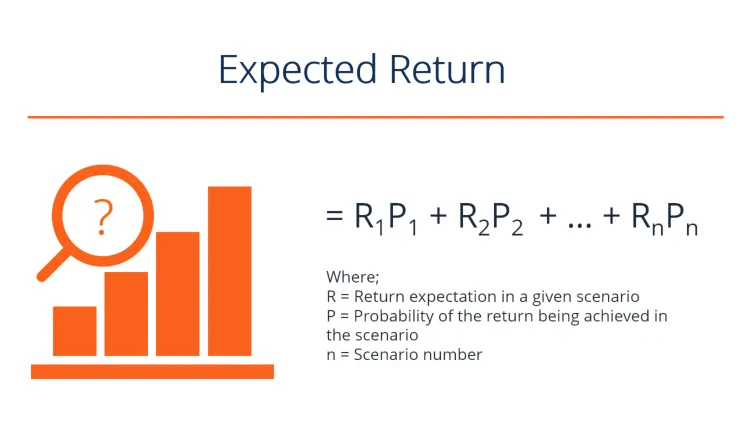

The Expected Return is the average expected gain or loss from an investment, calculated using historical data. This figure reflects the average performance of a security or portfolio over time. It can be calculated by multiplying each possible rate of Return by its probability of occurring and adding them all together.

Standard deviation measures how much variation exists in a given dataset. It can be used to measure how volatile an investment is and assess the risk associated with it. To calculate the standard deviation, you must take the square root of the variance. Variance is calculated by subtracting the expected Return from each rate of Return, squaring this number, multiplying it by its probability, and adding all of these numbers together.

FAQs

What is Expected Return?

Expected Return, also known as expected value, measures the average outcome when an investment option is chosen over many trials. It is calculated by multiplying each possible Return from a given stock or asset by its probability of occurring, then adding all of those products to get the expected Return for that stock or asset.

What is Standard Deviation?

Standard deviation is a measure used to quantify the variation in data points. It measures how much values deviate from the average, or mean, over multiple trials. The larger the Standard deviation, the more likely it is that individual results will vary from the mean.

What is the Difference between Expected Return and Standard Deviation?

The main difference between expected Return and Standard deviation lies in what they measure. Expected Return measures the average outcome when an investment option is chosen over many trials.

In contrast, standard deviation measures how much values deviate from the mean in a given set of data points. The expected Return is used to assess the profitability of an investment, while standard deviation is used to measure the risk associated with a particular stock or asset.

How are Expected Return and Standard Deviation Used Together?

Expected Return and Standard Deviation can be used together to measure the profitability of an investment in terms of its risk-reward ratio.

Expected Return describes the average Return one can expect over multiple trials, while standard deviation measures how much values deviate from this average. Thus, a higher expected return combined with a lower standard deviation can indicate a more profitable, less risky investment opportunity.

Conclusion

I hope this overview has shed some light on the difference between Expected Return and Standard Deviation. Expected Return is a measure of the anticipated Return on investment. At the same time, Standard deviation measures how much an investment's returns could vary from its expected value.

Both are important metrics to consider when evaluating an investment, and understanding their differences can help you make more informed decisions about where to invest your money.