A Detailed Understanding Your Insurance Binder

Introduction

Knowing how your insurance binder works are essential to helping you understand your coverage and what steps you should take if an event affects your policy. A binder is an agreement between an insurance company and a person or business that outlines the insurance coverage provided. It provides details about the nature of the coverage and any terms or conditions that may apply. This article will provide a detailed understanding of what an insurance binder is, how it works, and what you should do if you need to use it.

What is an Insurance Binder?

An insurance binder is a document issued by an insurance company to indicate provisional coverage has been granted for a specified period, usually 30 days. It typically indicates that the policyholder has valid and active coverage with their insurer until the policy can be issued. The binder outlines the terms of the policy, including who it covers and what kind of coverage has been granted as well as any exclusions or limitations.

Purpose of an Insurance Binder

The purpose of an insurance binder is to provide immediate proof that you have purchased insurance and are in compliance with applicable laws or regulations. For example, if you need to register a vehicle or obtain a loan, you may be required to submit proof of insurance before the process can be completed. An insurance binder serves as that proof until the policy documents can be issued.

How Does Insurance Binder Work?

Once you've requested an insurance binder, your insurer will review the information to ensure it is accurate and up-to-date. Once approved, they'll issue a binder outlining the terms and conditions of the policy. As long as you meet all requirements outlined in the policy, your coverage should remain active until the expiration date.

What is Included in an Insurance Binder?

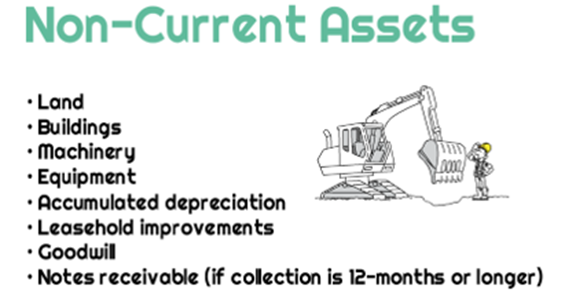

- Insurance binders typically include several key pieces of information, such as:

- The name of the insured and any other persons covered by the policy

- The type and amount of coverage included with the policy

- The start date and expiration date of the policy coverage

- Any exclusions or limitations on coverage

- Policy premium payment details

- Contact for questions about the policy coverage

- All this information must be accurate and up-to-date, as even a small error could result in a claim being denied or the policyholder needing to be covered.

Requesting an Insurance Binder

Typically, insurance binders are requested when someone is purchasing a new policy or making changes to an existing one. It's important to understand that the binder is not an official policy document and may only be valid for a certain period (typically 30 days). If you need to keep your coverage active after the expiration date, you must contact your insurer and have them issue an updated binder before the expiration date passes.

Renewing Your Insurance Binder

If you need to renew your insurance binder, you'll need to contact your insurer to make any changes or updates to the policy and then have them issue an updated binder. In some cases, you can do this online. It's important to remember that an insurance binder is not a guarantee of coverage. You must still meet all requirements outlined in your policy for it to remain active.

Canceling Your Insurance Binder

If you decide to cancel your insurance policy, you'll need to contact your insurer and inform them of your decision. The insurer will then typically cancel the policy and send you a confirmation letter or email outlining the cancellation date and any applicable refund amount (if applicable).

What Should You Do if You Need to Use Your Insurance Binder?

If you need to use your insurance binder, you'll need to submit a copy and other required documents or forms as proof of coverage. All the information on the binder must be correct and up-to-date. Contact your insurer before submitting the binder if you need to make any changes or updates.

Conclusion

An insurance binder is a temporary document used as proof of insurance until a policy can be issued. It includes important information such as the type and amount of coverage included in the policy, the start and expiration dates of the policy, and any exclusions or limitations on coverage. It's important to understand that an insurance binder is not a guarantee of coverage, and you must still meet all requirements outlined in the policy for it to remain active. If you need to use your insurance binder as proof of coverage, ensure all information is accurate and up-to-date before submitting it.